We’ve curated a list of the top 44 AI startups in Germany to watch in 2026.

From generative AI and enterprise automation to robotics, healthcare, climate tech, and industrial intelligence, these companies are redefining how software, data, and machines shape the real world.

Let’s dive in.

1. Helsing

Industry: Defence Technology / Artificial Intelligence / Autonomous Systems

Helsing is a German defence AI company that develops advanced artificial intelligence software and autonomous systems for military applications, including battlefield decision support, autonomous drones and sensor fusion platforms designed to enhance situational awareness and defence capabilities for democratic governments.

Location: Munich, Bavaria, Germany

Founded: 2021

Last Funding Round: €600M Series D (2025)

Total Funding: ~€1.37B+ (~$1.58B approx.) disclosed across rounds (Series A, B, C, D)

Valuation: ~€12B (~$12B+ estimated, 2025)

Number of Users: Not publicly disclosed (primarily government and defence contracts)

Growth Rate: Rapid funding growth and expansion into autonomous systems and defence markets (not formally disclosed)

Key Features

AI-enabled autonomous defence systems, battlefield decision software, AI-powered autonomous drones (HX-2, HF-1), underwater systems (SG-1 Fathom), AI electronic warfare tools, sensor fusion platforms, strategic partnerships with governments and defence primes, focus on sovereign democratic defence applications.

2. Black Forest Labs

Industry: Artificial Intelligence / Generative AI / Visual Intelligence

Black Forest Labs is a German AI research lab building state-of-the-art generative models for image and visual content creation, including its flagship FLUX models used by creators, developers and enterprise partners for text-to-image and editing workflows.

Location: Freiburg im Breisgau, Baden-Württemberg, Germany

Founded: 2024

Last Funding Round: $300M Series B (2025)

Total Funding: ~$450M+ disclosed funding

Valuation: ~$3.25B (2025)

Number of Users: Not publicly disclosed (enterprise and developer usage via API and integrations)

Growth Rate: Achieving a $3.25 billion valuation in less than 18 months by December 2025

Key Features

FLUX generative AI models for high-quality text-to-image generation and editing, API access for developers and enterprise use, production-grade visual intelligence capabilities with photorealistic output, partnerships with creative and platform companies.

3. n8n

Industry: AI Workflow Automation / SaaS / Low-Code Automation

n8n is a German company that builds a workflow automation and orchestration platform combining AI, code, and visual low-code tools to help businesses automate processes and integrate apps without vendor lock-in.

Location: Berlin, Germany

Founded: 2019

Last Funding Round: $180M Series C at a $2.5B valuation (October 2025)

Total Funding: ~$250M+ disclosed funding

Valuation: ~$2.5B (2025)

Number of Users: ~230,000+ active users across free and paid plans, 3,000+ enterprise customers

Growth Rate: 6x year-over-year user growth

Key Features

Visual low-code workflow builder, AI-augmented automation, 1000+ app integrations, self-hosted and cloud options, fair-code licensing, scalable enterprise automation solutions.

4. DeepL

Industry: Artificial Intelligence / Language AI / Translation Software

DeepL is a German AI company that builds advanced neural machine translation and language understanding tools for individuals and businesses, offering highly accurate text and document translation, writing assistance, real-time speech translation, and API integration.

Location: Cologne, North Rhine-Westphalia, Germany

Founded: 2017

Last Funding Round: ~$300M funding with a $2B valuation (2024)

Total Funding: ~$400M total disclosed funding

Valuation: ~$2.0B (estimated, 2025 post-money)

Number of Users: ~100,000+ business customers; millions of individual users worldwide (not exact public total users figure available)

Growth Rate: Reports note rapid global adoption and expansion but no standardized growth metric publicly released

Key Features

AI-powered neural machine translation, document translation preserving original formatting, API for developers, multilingual writing assistant (DeepL Write), real-time speech translation, GDPR and enterprise security compliance, browser and mobile apps, support for 32+ languages, enterprise SaaS subscriptions.

5. Agile Robots

Industry: Artificial Intelligence / Robotics / Industrial Automation

Agile Robots is a German AI and robotics company building AI-driven intelligent robotic systems and automation solutions that combine machine learning, advanced robotics hardware and software to accelerate smart manufacturing, precision assembly and real-world industrial automation.

Location: Munich, Bavaria, Germany (dual HQ includes Beijing, China)

Founded: 2018

Last Funding Round: ~$220M Series C led by SoftBank Vision Fund 2 (2020–2021)

Total Funding: ~$240M+ disclosed funding

Valuation: >$1B (unicorn status)

Number of Users: Not publicly disclosed (industrial and enterprise clients)

Growth Rate: Rapid revenue doubling year-over-year since founding (reached ~€200M in 2024)

Key Features

AI-empowered industrial robots and systems, AI foundation models for robotics, intelligent robotic arms and hands, autonomous mobile platforms, integrated AgileCore software for robot coordination, production-ready humanoid robots (Agile ONE) and global smart manufacturing solutions.

6. osapiens

Industry: Artificial Intelligence / ESG Compliance & Operational AI

osapiens is a German cloud software company that builds an AI-powered platform (osapiens HUB) to help enterprises automate ESG compliance, sustainability reporting, supply chain transparency and operational performance across global value chains.

Location: Mannheim, Baden-Württemberg, Germany

Founded: 2018

Last Funding Round: ~$120M Series B led by Goldman Sachs Alternatives (2024)

Total Funding: ~$120M+ disclosed funding

Valuation: Over $1B

Number of Users: ~2,000+ enterprise customers worldwide

Growth Rate: Rapid global expansion with significant new client additions (2024–2025)

Key Features

AI-powered ESG and compliance automation, unified data platform, real-time sustainability reporting, supply chain risk monitoring, regulatory compliance support for CSRD/EUDR/CSDDD, operational efficiency tools.

7. Parloa

Industry: Artificial Intelligence / Conversational AI / Customer Service AI

Parloa is a German AI company that builds an enterprise-grade AI Agent Management Platform to automate customer service interactions with natural, agentic AI agents that engage in voice and chat across contact centers, helping companies enhance customer experience, reduce support costs and scale service operations.

Location: Berlin, Germany (offices also in Munich and New York)

Founded: 2018

Last Funding Round: $120M Series C (2025)

Total Funding: ~$214M+ disclosed funding (including Series A, B and C)

Valuation: ~$1B (unicorn status, 2025)

Number of Users: Not publicly disclosed (enterprise global customers including Fortune 200 and major brands)

Growth Rate: ~150%+ revenue retention and rapid global expansion (2025 highlights)

Key Features

AI Agent Management Platform (AMP) for automating customer support, natural language conversation, omnichannel voice and chat automation, scalable deployment for contact centers, enterprise integrations and analytics.

8. Aleph Alpha

Industry: Artificial Intelligence / Generative AI / Large Language Models

Aleph Alpha is a German AI company developing sovereign large language models and enterprise-grade generative AI solutions focused on privacy, security, and regulatory compliance for businesses and governments.

Location: Heidelberg, Baden-Württemberg, Germany

Founded: 2019

Last Funding Round: ~$500M Series B (2023)

Total Funding: ~$500M+ total disclosed funding

Valuation: $490M in June 2023.

Number of Users: Not publicly disclosed, primarily enterprise and government customers

Growth Rate: Aleph Alpha hit $110.9M revenue with a 341 person team in 2025

Key Features

Large language models for enterprise and government use, sovereign and privacy-focused AI deployments, PhariaAI generative AI platform, multilingual capabilities, GDPR and EU AI Act alignment, on-premise and secure cloud deployment options.

9. Tacto

Industry: Artificial Intelligence / Enterprise Software / Procurement AI

Tacto is a German AI company that builds an AI-powered procurement intelligence platform to help industrial and mid-sized companies automate purchasing, supplier management, spend analytics and supply chain workflows using data-driven automation and strategic AI agents.

Location: Munich, Bavaria, Germany

Founded: 2020

Last Funding Round: €50M Series A (2023) led by Sequoia Capital and Index Ventures

Total Funding: ~€56M+ disclosed (Seed + Series A)

Valuation: Estimated ~$300M

Number of Users: Not publicly disclosed (industrial procurement teams)

Growth Rate: Reached an estimated $11.4M in revenue by September 2025

Key Features

AI-driven spend intelligence and savings identification, automated supplier and compliance management, integrated procurement workflows, ERP and market data linking for strategic sourcing insights, RFQ automation and risk detection.

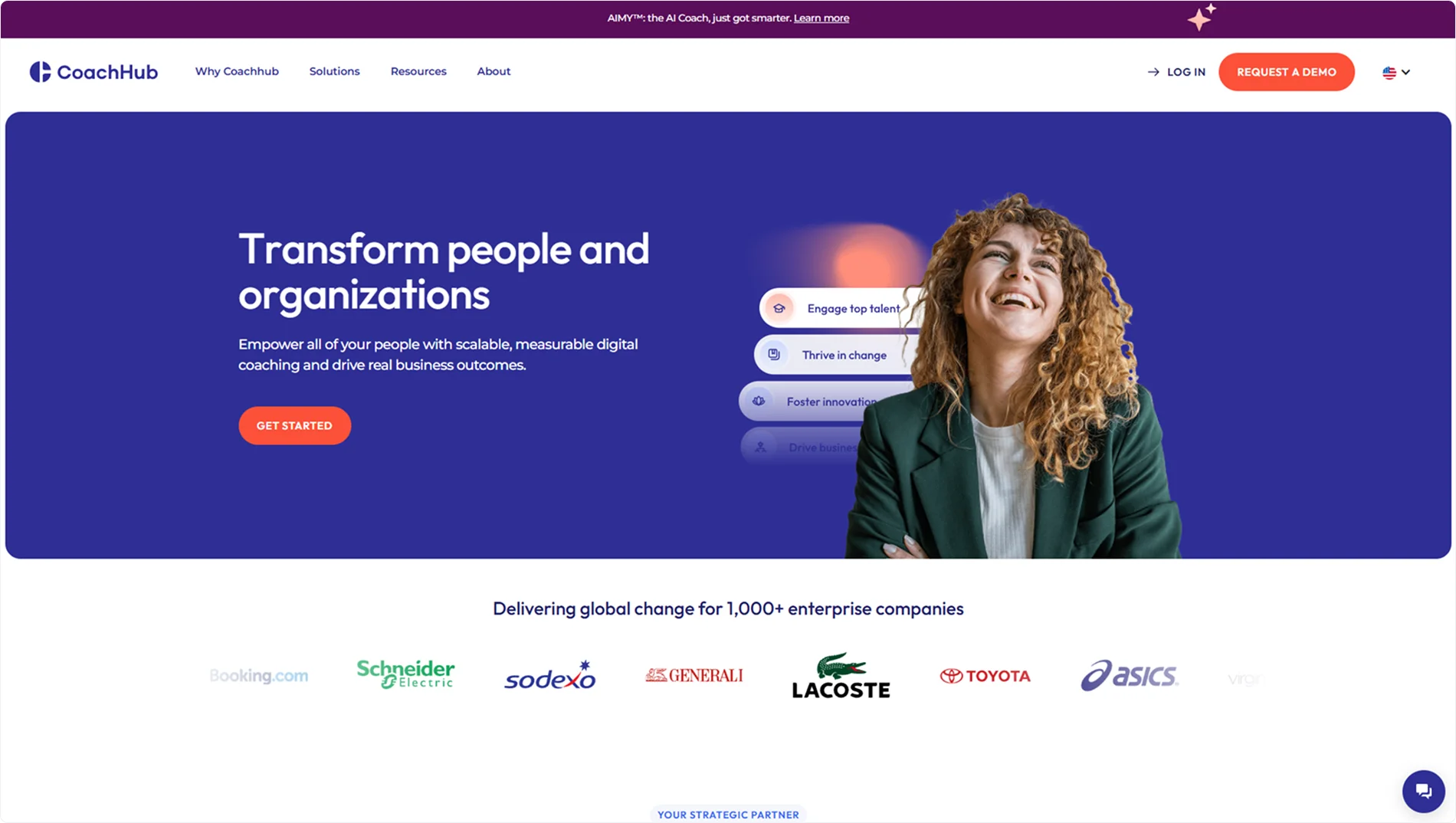

10. CoachHub

Industry: Digital Coaching / HR Tech / Enterprise Talent Development

CoachHub is a German global digital coaching platform that enables organizations to deliver scalable, measurable personalized coaching programs to employees at all levels, combining AI matching with a network of certified business coaches to drive professional growth.

Location: Berlin, Germany

Founded: 2018

Last Funding Round: $200M Series C (2022)

Total Funding: ~$330M+ total disclosed funding

Valuation: Not publicly disclosed

Number of Users: >1,000 enterprise clients worldwide, coaches in 90+ countries

Growth Rate: ~44.7% year-over-year growth rate

Key Features

AI-enabled coach matching, 3,500+ certified global business coaches, scalable one-on-one and team coaching, digital coaching analytics, personalized development resources.

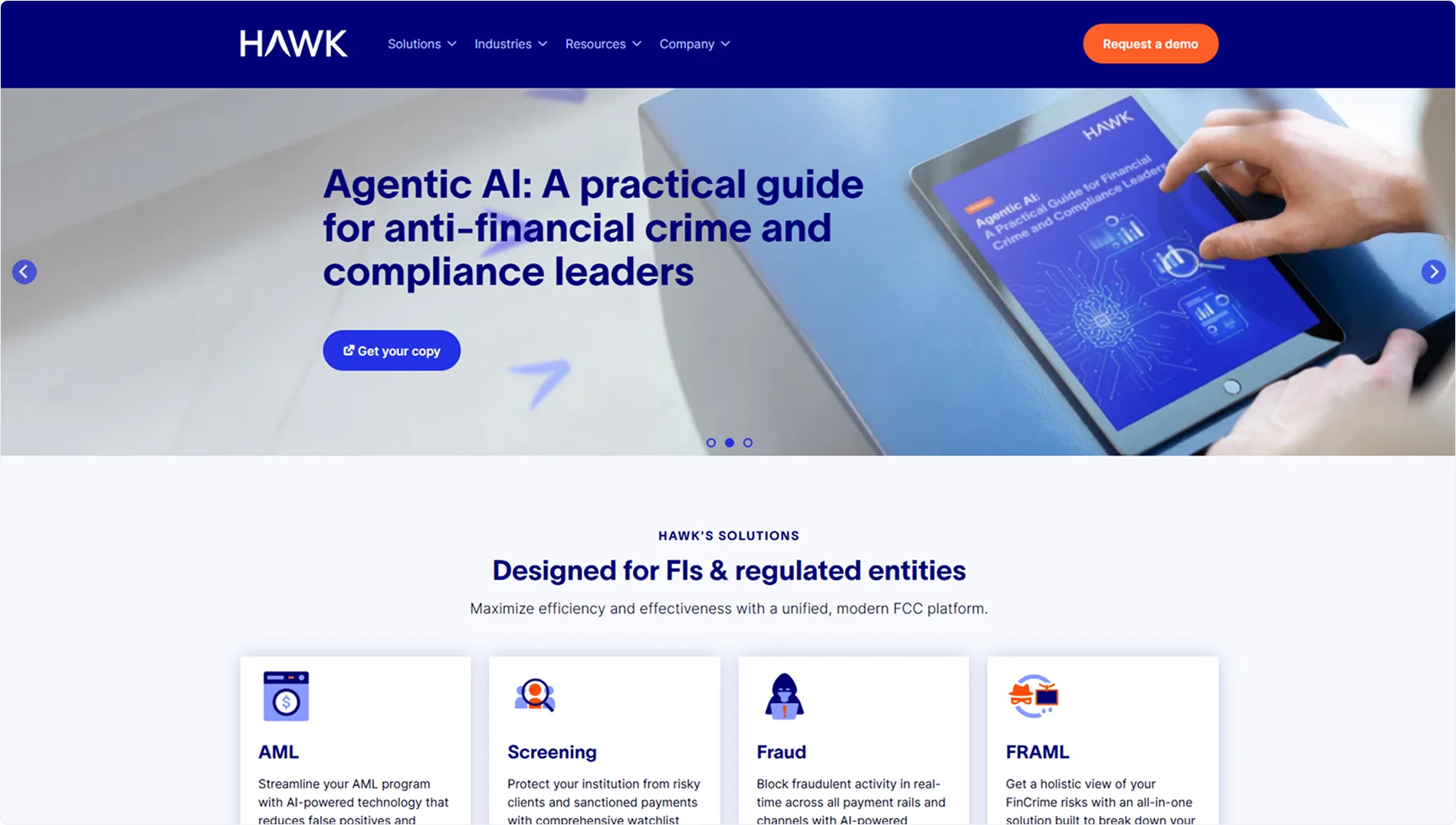

11. Hawk

Industry: Artificial Intelligence / FinTech / RegTech / Anti-Financial Crime AI

Hawk is a German AI company that builds AI-powered anti-money-laundering (AML), fraud detection and financial crime prevention software for banks, payment companies and fintechs, using explainable machine learning to improve detection accuracy and reduce false positives in compliance systems.

Location: Munich, Bavaria, Germany

Founded: 2018

Last Funding Round: ~€56M Series C (2025) led by One Peak and existing investors

Total Funding: ~€174M+ total disclosed across seed through Series C

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (used by 80+ financial institutions globally)

Growth Rate: Not publicly disclosed (rapid global expansion into US, APAC and Europe)

Key Features

AI-driven AML and fraud surveillance, explainable machine learning, real-time transaction monitoring, modular compliance platform, reduced false positives, regulatory reporting and risk management tools.

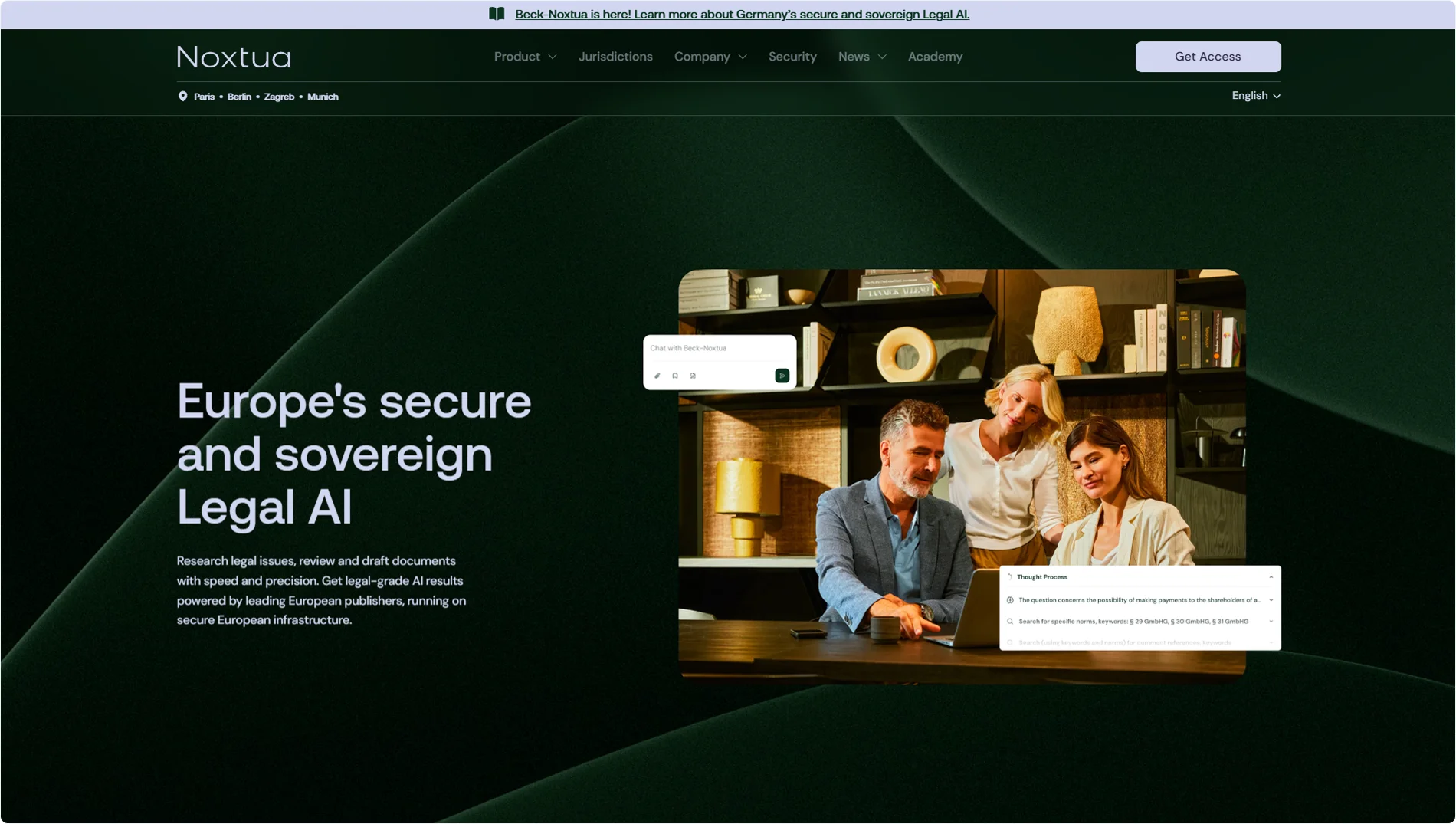

12. Noxtua

Industry: Artificial Intelligence / Legal AI / LegalTech

Noxtua is a German AI company that builds a sovereign Legal AI platform and LLM tailored for lawyers, law firms and legal departments to research, analyse, summarise and draft legal documents with high compliance and data protection standards.

Location: Berlin, Germany

Founded: 2017 (emerged from research project and startup Xayn)

Last Funding Round: ~$92–$108M Series B (2025) led by C.H.Beck, CMS, Dentons and others

Total Funding: ~$110M+ disclosed

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (legal professionals and law firms)

Growth Rate: Not publicly disclosed (expanding partnerships and European deployments)

Key Features

AI-driven legal research and document analysis, contract review and drafting, matrix-style structured legal insights, sovereign GDPR-compliant deployment in European data centers, multilingual support (German/English) and integrations with legal workflows.

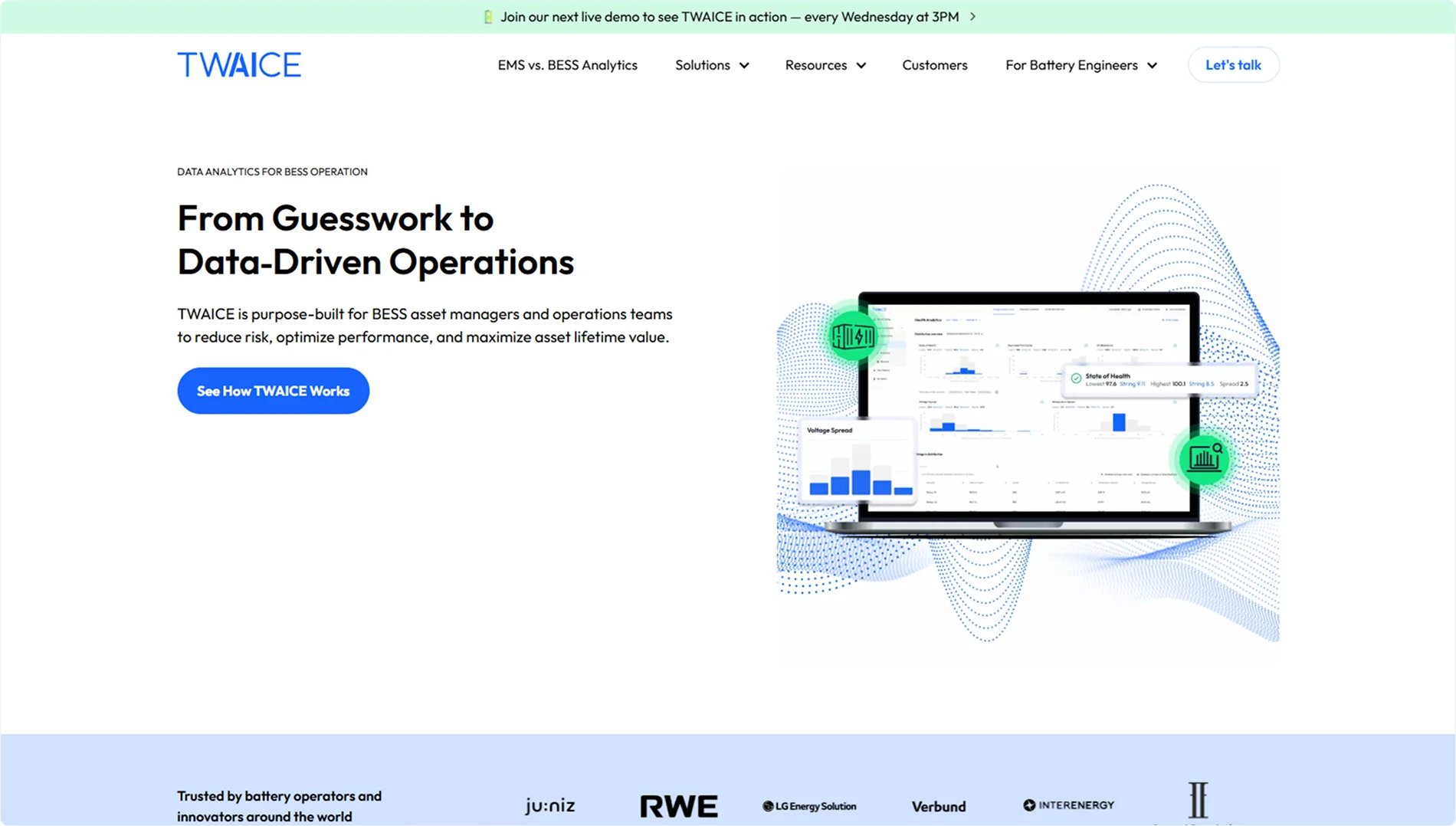

13. Twaice

Industry: Artificial Intelligence / Battery Analytics / Predictive Analytics

Twaice is a German AI and analytics company that builds predictive battery analytics software using digital twin technology to help electric vehicle manufacturers, energy storage operators and industrial clients monitor, predict and optimise battery health, performance, lifespan and safety throughout the full lifecycle.

Location: Munich, Bavaria, Germany

Founded: 2018

Last Funding Round: Series B $30M and €21.3M tranches (2021–2022)

Total Funding: ~$90M+ disclosed (Seed, Series A, Series B)

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (enterprise customers include major OEMs and energy storage operators)

Growth Rate: Not publicly disclosed (notable international expansion and strong customer adoption)

Key Features

AI and machine learning-enhanced digital twin battery models, predictive lifespan and degradation forecasting, real-time battery health analytics, optimisation of performance and safety, warranty and second-life insights for lithium-ion batteries across EV and energy storage systems.

14. Makersite

Industry: Artificial Intelligence / Product Lifecycle Intelligence / Supply Chain & Sustainability AI

Makersite is a German AI-powered software company that builds a product lifecycle intelligence platform using AI, data and graph technology to help manufacturers optimise product sustainability, cost, compliance and supply chain risk with digital twins and real-time analytics.

Location: Stuttgart, Baden-Württemberg, Germany

Founded: 2018

Last Funding Round: €60M Series B (2025)

Total Funding: ~€78M+ disclosed (including Series A and B)

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (enterprise manufacturers as customers)

Growth Rate: $10 million in annual revenue by September 2025

Key Features

AI-driven product and supply chain digital twins, automated lifecycle assessment (LCA), sustainability and carbon footprint insights, cost and compliance analytics, deep integration with PLM/ERP systems, real-time multi-criteria decision support for product design teams.

15. Scoutbee

Industry: Artificial Intelligence / Procurement Tech / Supply Chain AI

Scoutbee is a German AI-powered supplier intelligence and discovery platform that helps procurement and supply chain teams automate strategic sourcing, find and evaluate suppliers using machine-learning and data-driven supplier profiles to strengthen resilience, reduce time-to-source and advance ESG and supplier diversity strategies.

Location: Berlin, Germany (originally Würzburg, now global presence with a remote-centric team)

Founded: 2015

Last Funding Round: ~$76M total funding raised prior to acquisition (acquired by Coupa in 2025)

Total Funding: ~$76M disclosed before acquisition

Valuation: Not publicly disclosed (acquisition terms undisclosed)

Number of Users: ~150+ enterprise customers (as of 2024)

Growth Rate: Scoutbee's revenue grew from $5.5M in December 2023 to $15M by November 2024

Key Features

AI-driven supplier discovery and profiling, deep supplier insights and predictive analytics, generative AI for strategic sourcing questions, supply base visibility and risk analytics, integration with enterprise procurement workflows and SAP Ariba, ESG and diversity-focused sourcing tools.

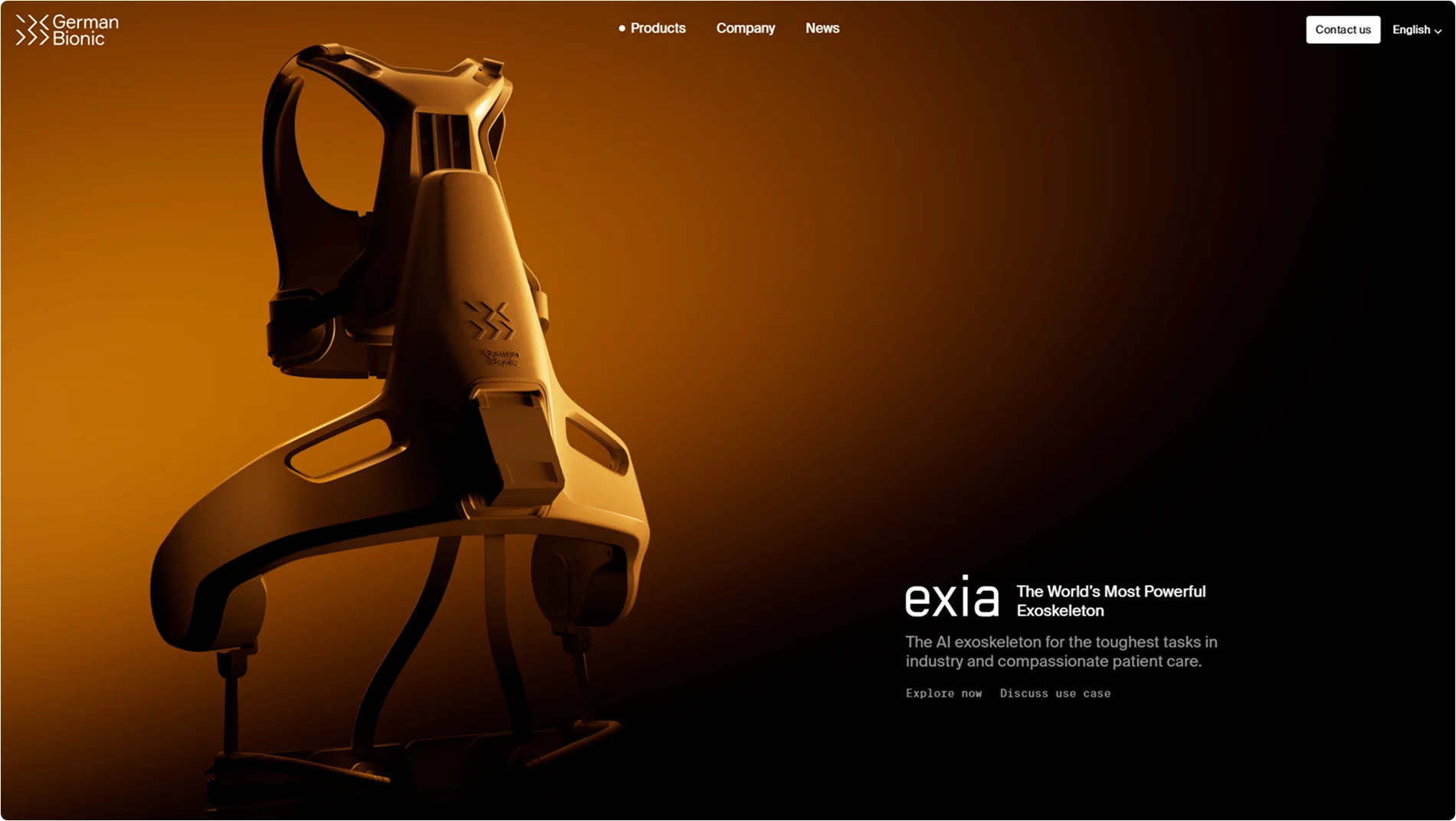

16. German Bionic

Industry: Artificial Intelligence / Robotics / Wearable Exoskeletons

German Bionic is a German AI and robotics company that develops intelligent, self-learning wearable exoskeleton power suits that support workers in physically demanding jobs by enhancing lifting, posture and movement to reduce strain and injury while improving workplace efficiency through connected data and machine learning.

Location: Augsburg and Berlin, Germany (offices also in Boston, Tokyo, Paris)

Founded: 2016–2017

Last Funding Round: ~$20M Series A (2020) led by Samsung Catalyst Fund and others

Total Funding: ~$60M+ disclosed across equity and debt, including €15M venture debt from the European Investment Bank

Valuation: Not publicly disclosed (company entered insolvency proceedings in late 2025 due to a withdrawn funding round)

Number of Users: Not publicly disclosed (B2B industrial and healthcare partners deploying exosuits)

Growth Rate: Not publicly disclosed (rapid technology adoption before 2025 restructuring)

Key Features

AI-powered connected exoskeletons (Cray X, EXIA, Apogee) for lifting and ergonomic support, real-time sensor data analytics, machine-learning posture and movement optimisation, cloud connectivity for continuous improvement and ergonomic workflow insights.

17. Voize

Industry: Artificial Intelligence / Voice AI / Healthcare AI

Voize is a German AI company that builds AI-powered speech recognition and voice documentation software designed to help healthcare professionals and other workers quickly dictate and auto-generate structured documentation, reducing admin time and improving workflow efficiency.

Location: Berlin, Germany

Founded: 2020

Last Funding Round: $50M Series A (2025)

Total Funding: ~$59M+ disclosed (including $9M Seed + $50M Series A)

Valuation: Not publicly disclosed

Number of Users: ~75,000+ nurses and 1,100+ care facilities (estimated)

Growth Rate: The company has reported 3× year-on-year growth

Key Features

AI-driven speech recognition for hands-free documentation, automated structured report generation, voice-to-EHR integration, real-time language understanding including medical terminology and dialect support, workflow acceleration for nurses and care staff.

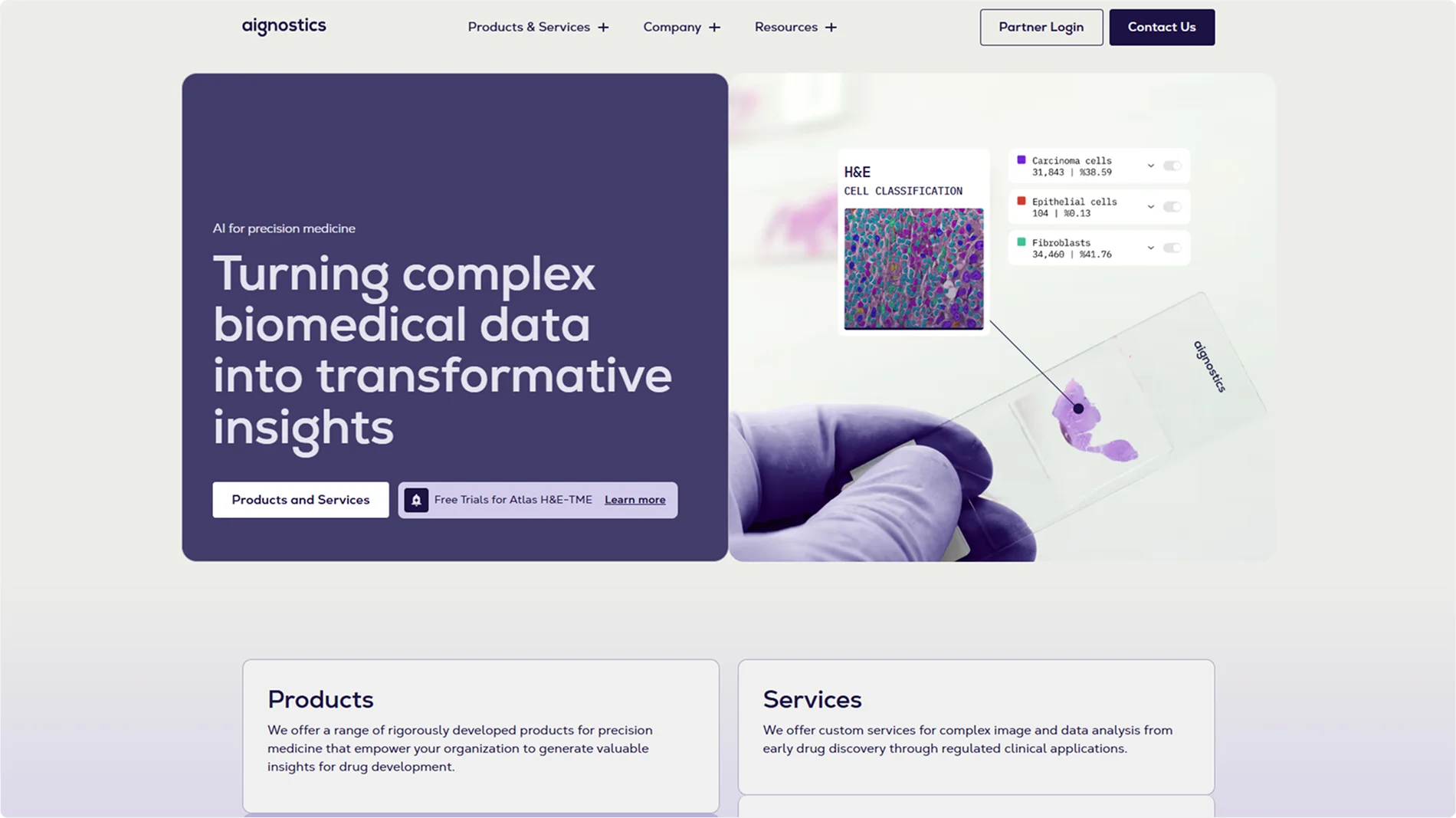

18. Aignostics

Industry: Artificial Intelligence / Healthcare AI / Precision Medicine

Aignostics is a German AI company that builds advanced AI-powered computational pathology and precision diagnostics solutions to transform complex multi-modal biomedical data into actionable insights for drug discovery, translational research, clinical trials and companion diagnostics.

Location: Berlin, Germany

Founded: 2018 (spin-off from Charité – Universitätsmedizin Berlin)

Last Funding Round: $34M Series B (2024)

Total Funding: ~$55M+ disclosed funding

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (enterprise biopharma and research clients)

Growth Rate: Not publicly disclosed

Key Features

AI-driven pathology analysis, multi-modal data integration, foundation models for pathology, precision medicine insights, support for drug development, translational research and clinical trial analytics.

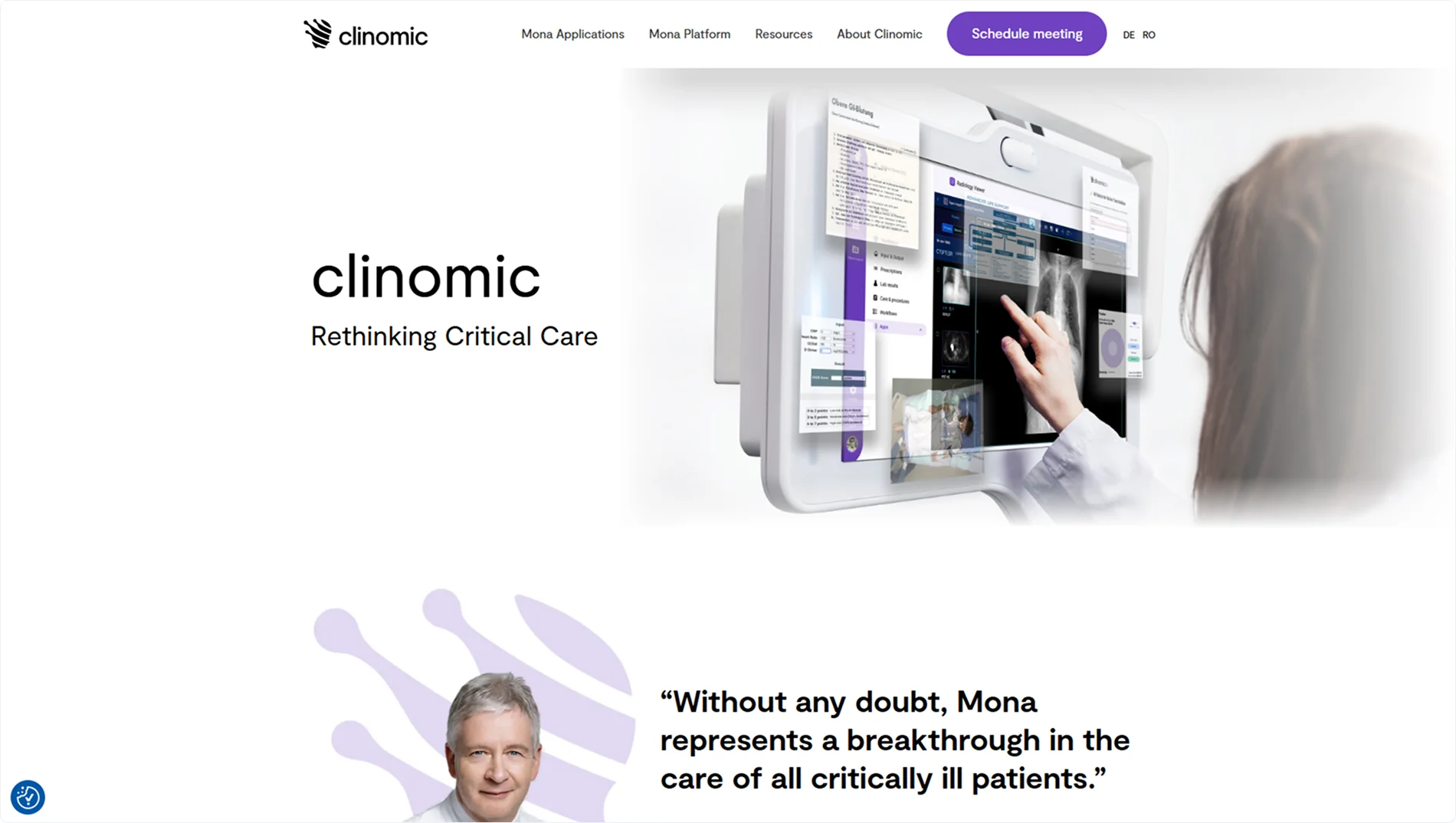

19. Clinomic AI

Industry: Artificial Intelligence / Healthcare AI / MedTech

Clinomic AI (Clinomic Group) is a German medical AI company building AI-driven software and data platforms (e.g., Mona) to optimize intensive care unit workflows, streamline clinical decision-making and improve patient outcomes in acute and critical care settings.

Location: Aachen, North Rhine-Westphalia, Germany

Founded: 2019

Last Funding Round: €23M Series B (2025)

Total Funding: ~€50M+ disclosed (including earlier rounds)

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (deployed in hospitals and ICU networks)

Growth Rate: Implemented in over 40 hospitals across 8 EU countries

Key Features

AI-powered ICU data analytics and decision support, integrated patient data management, real-time clinical insights, workflow optimization and teleICU capabilities.

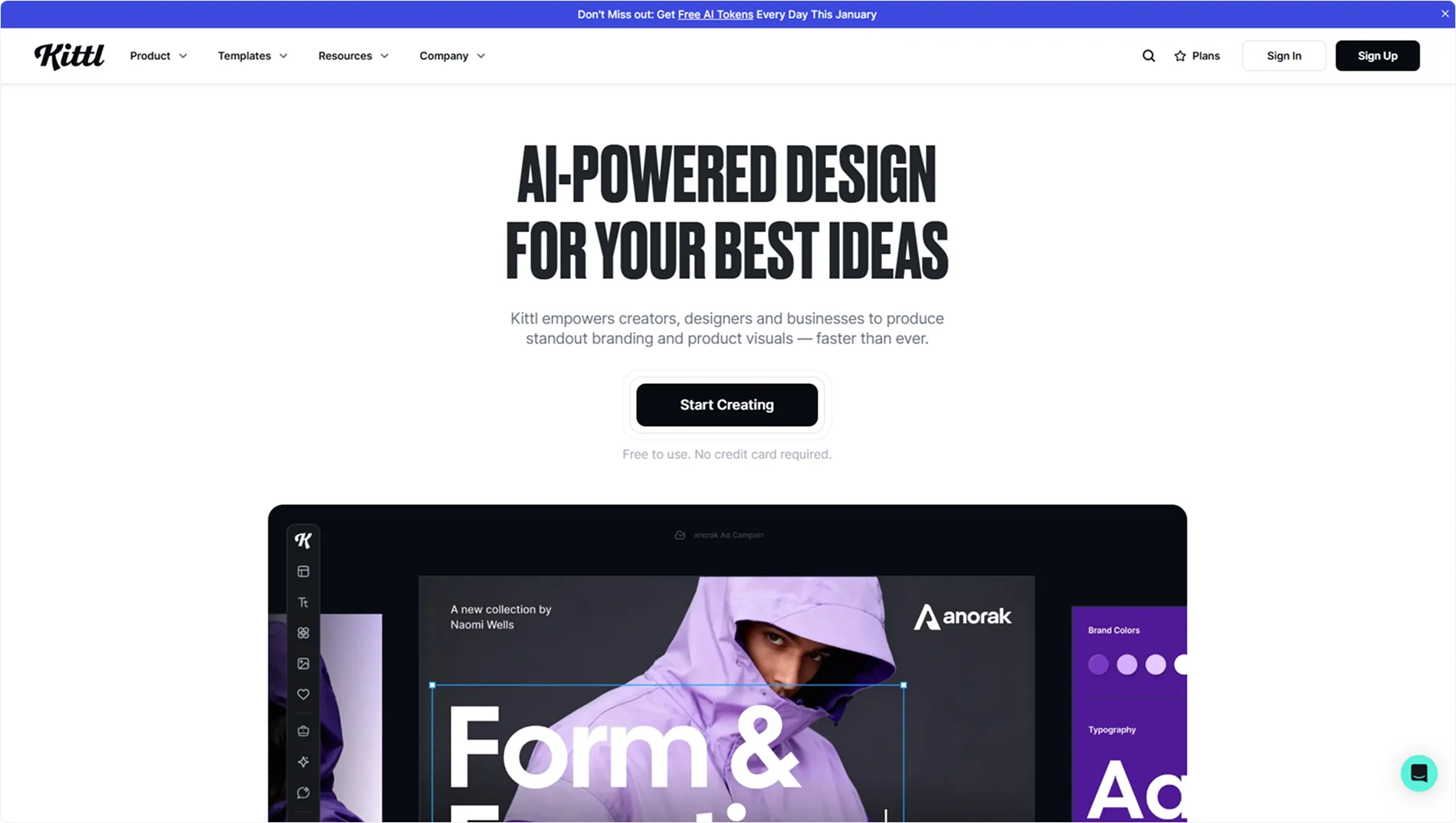

20. Kittl

Industry: Artificial Intelligence / Creative Software / Design AI

Kittl is a German AI-enhanced graphic design platform that enables creators, designers and small businesses to generate professional-quality visual assets (logos, posters, packaging, social media graphics and more) using intuitive tools and AI-assisted workflows, positioning itself as a powerful alternative to traditional design tools.

Location: Berlin, Germany (with offices in Düsseldorf and expanding internationally)

Founded: 2020

Last Funding Round: $36M Series B (2024) led by IVP

Total Funding: ~$45M–$50M+ disclosed funding

Valuation: Not publicly disclosed

Number of Users: ~10,000,000+ users worldwide (2025)

Growth Rate: Grew to over 1 million users by January 2024, with a rapid acceleration to 10 million by December 2025

Key Features

AI-powered design and creative tools, extensive template and asset library, browser-based vector and image editor, text-to-image and vector generation, mockup and branding assets, collaborative workflows and scalable design outputs.

21. Buena

Industry: PropTech / AI‑Enabled Property Management

Buena is a Berlin-based PropTech startup that builds an AI-powered property management platform and service to automate routine administrative tasks such as bookkeeping, financial reporting and tenant coordination while also acquiring and digitising local property management firms to scale operations.

Location: Berlin, Germany

Founded: 2023

Last Funding Round: ~$58M Series A (2025)

Total Funding: ~€49M+ disclosed funding

Valuation: Not publicly disclosed

Number of Users: ~60,000+ managed residential units, 5,000+ landlords on waitlist

Growth Rate: Revenue growth ~500% in 2024, ~300% in 2023

Key Features

AI-assisted property management automation, accounting and financial workflow automation, acquisition-enabled scaling of local management firms, landlord and tenant support tools.

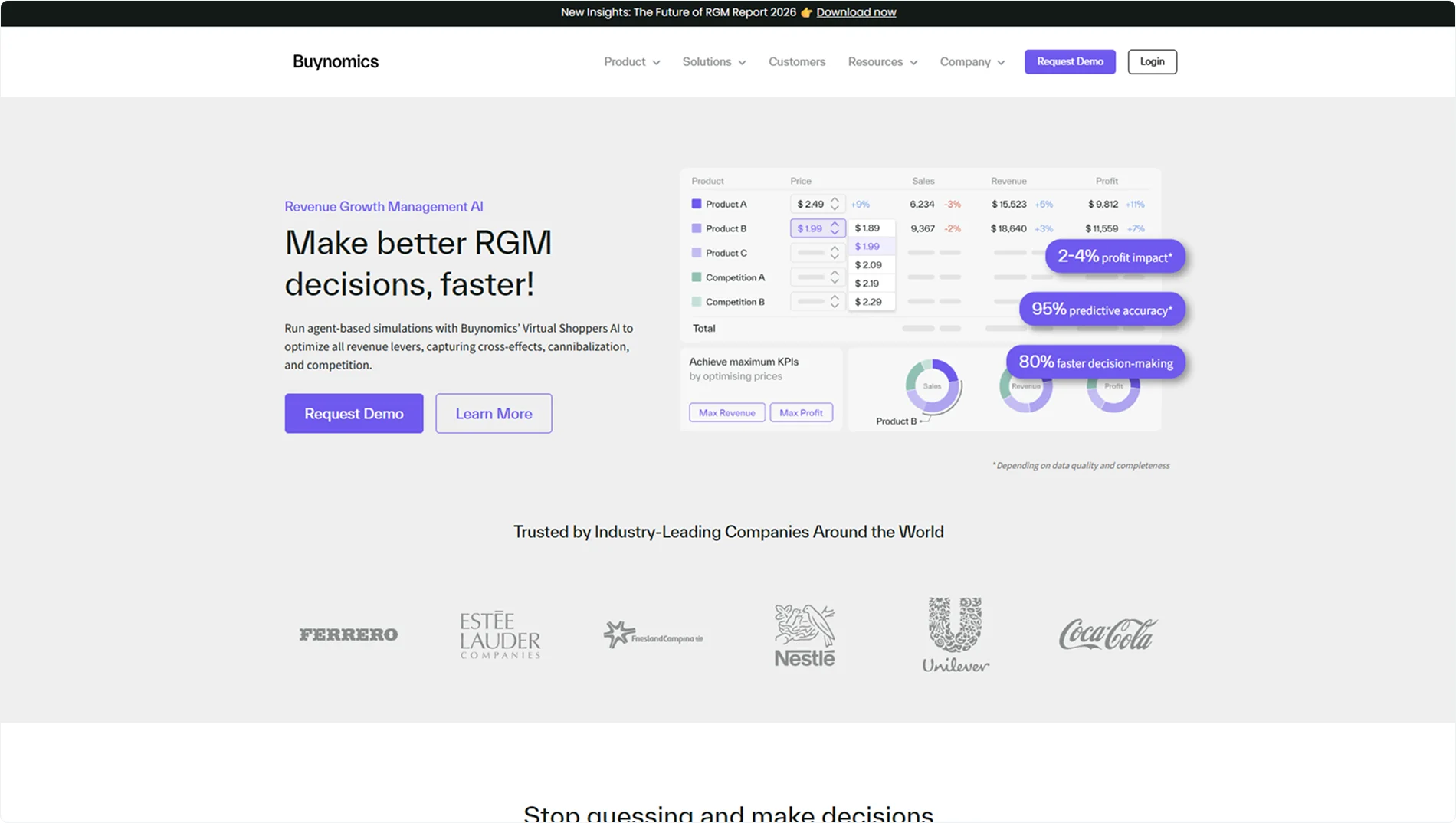

22. Buynomics

Industry: Artificial Intelligence / Pricing & Revenue Optimization

Buynomics is a German AI company that builds an AI-powered commercial operating system to help enterprises optimize pricing, promotions, product portfolios and revenue decisions by simulating real shopper behavior.

Location: Cologne, North Rhine-Westphalia, Germany

Founded: 2018

Last Funding Round: $30M Series B (2025)

Total Funding: ~$45M+ disclosed funding

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (used by enterprises like Danone, Unilever, L’Oréal, Vodafone)

Growth Rate: Year-over-year (YOY) growth rate of approximately 59%

Key Features

AI-driven pricing and revenue optimization, Virtual Shoppers AI simulation technology, predictive and prescriptive insights for pricing and promotions, real-time commercial decision support for enterprise customers.

23. Deepset

Industry: Artificial Intelligence / Natural Language Processing / Enterprise AI

Deepset is a German AI company that builds developer tools and enterprise platforms for advanced natural language processing (NLP), semantic search, retrieval-augmented generation (RAG) and customizable AI applications using the open-source Haystack framework and enterprise SaaS capabilities.

Location: Berlin, Germany

Founded: 2018

Last Funding Round: $30M Series B (2023)

Total Funding: ~$45M+ disclosed across rounds including pre-seed, Series A and B

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (enterprise customers include Airbus, The Economist, OakNorth and others)

Growth Rate: Not publicly disclosed (recognized as a rising B2B SaaS leader in 2025)

Key Features

Open-source Haystack framework for building scalable NLP applications (semantic search, document QA, RAG, text-to-SQL), enterprise AI platform for model orchestration and deployment, secure on-premise and cloud options, customizable AI agents and workflows.

24. Mirelo

Industry: Artificial Intelligence / Audio AI / Generative Media

Mirelo is a German AI company building generative AI models and tools that automatically create synchronized sound effects and audio for videos, enabling creators to enhance visual content with high-quality, emotionally-aligned soundtracks in seconds.

Location: Berlin, Berlin, Germany

Founded: 2023

Last Funding Round: $41M Seed (2025) co-led by Index Ventures and Andreessen Horowitz

Total Funding: ~$44M+ disclosed

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (API and creator platform users)

Growth Rate: Not publicly disclosed

Key Features

AI-generated synchronized sound effects and ambient audio for video content, Mirelo Studio web app and API, foundation audio models requiring lower compute than typical LLMs, tools for fine-tuning and creative control for creators and studios.

25. 4screen

Industry: Mobility / In‑Car Digital Advertising / AI‑Enabled Driver Interaction

4screen is a German technology company that builds the world’s first driver interaction platform, enabling brands and businesses to engage drivers in real time through the digital screens of connected vehicles by leveraging contextual car data for location-based recommendations and interactions.

Location: Munich, Bavaria, Germany

Founded: 2020

Last Funding Round: ~€21M Series B (2025) led by Bosch Ventures, NewRoad Capital Partners and Bayern Kapital

Total Funding: ~€40M+ disclosed (including €21M Series A and €21M Series B)

Valuation: Not publicly disclosed

Number of Users: Millions of drivers accessing the platform via vehicles integrated with the 4screen system across 12+ countries

Growth Rate: Not publicly disclosed (rapid expansion with new OEM integrations and global rollout)

Key Features

Real-time driver engagement through in-car screens, contextual advertising and recommendations using car sensor data, partnerships with major automotive brands (Mercedes-Benz, Audi, Hyundai, Kia, Stellantis, Toyota), integration into OEM vehicle interfaces, scalable platform for brands to reach drivers with location-based content and offers.

26. JinaAI

Industry: Artificial Intelligence / Search AI / Neural Search

JinaAI is a company building open-source and enterprise AI tools focused on neural search, embeddings, rerankers, and multimodal search technologies that help developers and businesses build advanced information retrieval and AI-powered search applications.

Location: Berlin, Germany (headquarters) with presence in Sunnyvale, California and offices in Beijing and Shenzhen

Founded: 2020

Last Funding Round: $30M Series A (2021)

Total Funding: ~$37.5M+ disclosed funding

Valuation: Not publicly disclosed

Number of Users: ~250,000+ users and developer community (estimated from usage and community metrics)

Growth Rate: By July 2025, Jina AI reached an estimated annual revenue run rate of $6.3 million

Key Features

Neural search and retrieval-augmented generation tools, embeddings and reranking models, multimodal search support, open-source developer frameworks, cloud and local deployment options.

27. Trawa

Industry: Clean Energy / Energy Tech / AI-Powered Energy Procurement

Trawa is a German energy tech company that combines AI-driven software with renewable electricity procurement to help industrial and commercial businesses analyse consumption, optimise energy costs and access sustainable power portfolios tailored to their demand.

Location: Berlin, Germany

Founded: 2022

Last Funding Round: €24M Series A (2025) led by Headline with participation from Norrsken VC, Balderton Capital, Speedinvest, AENU, Magnetic and Tiny VC

Total Funding: ~€36M+ disclosed across seed and Series A rounds

Valuation: Not publicly disclosed

Number of Users: ~100+ commercial customers across 3,000+ locations in Germany and Austria

Growth Rate: Not publicly disclosed

Key Features

AI-powered energy consumption analysis and forecasting, optimised renewable electricity procurement including PPAs, energy cost reduction up to ~30%, integration of battery and flexibility solutions, real-time usage insights and automated portfolio optimisation.

28. Apheris

Industry: Artificial Intelligence / Federated Learning / Life Sciences AI

Apheris is a German AI company that builds secure federated data networks and privacy-preserving computing infrastructure to enable life sciences and pharmaceutical organizations to collaborate on sensitive proprietary data for AI model training and analytics without moving raw data.

Location: Berlin, Germany

Founded: 2019

Last Funding Round: ~$21M Series A (2025)

Total Funding: ~$32.5M+ disclosed funding

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (enterprise pharma and research customers)

Growth Rate: Not publicly disclosed

Key Features

Federated machine learning and secure data collaboration, privacy and IP protection for distributed data, compute gateway for AI model training across organizations, compliance with data governance requirements for healthcare and life sciences.

29. Solsten

Industry: Artificial Intelligence / AI-driven Customer Experience / Psychometrics & Digital Experience Analytics

Solsten is a German AI startup that builds AI-powered platforms to help brands and companies understand human psychology and audience behavior to design deeply resonating and healthier digital experiences, especially in gaming and digital entertainment. Their suite of products (e.g., Traits, Navigator, Frequency) combines psychological insight with machine learning to tailor experiences and improve engagement.

Location: Berlin, Germany (headquarters)

Founded: 2018

Last Funding Round: Series B (approx. $21.8M / €21.6M, 2022)

Total Funding: ~$31M+ (across rounds)

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (used by various gaming studios and digital businesses)

Growth Rate: As of late 2025, the company had already achieved $4.2 million in revenue, aiming to reach $5.2 million in ARR by the end of 2026

Key Features

AI-driven psychological analytics for audience understanding, products for traits analysis, audience discovery, and content performance prediction, used to inform product design, marketing decisions, and user experience optimization, focus on human-centric digital engagement across industries (notably gaming).

30. Synthflow

Industry: Artificial Intelligence / Conversational AI / Voice Automation

Synthflow is a German AI company that builds an enterprise-ready, no-code voice AI platform enabling businesses to automate phone calls and customer interactions with natural, context-aware AI voice agents for tasks like support, lead qualification and appointment scheduling.

Location: Berlin, Germany

Founded: 2023

Last Funding Round: $20M Series A (2025) led by Accel with participation from Atlantic Labs and Singular

Total Funding: ~$30M+ disclosed (including seed + Series A)

Valuation: Not publicly disclosed

Number of Users: ~1,000+ enterprise customers (est.)

Growth Rate: From mid-2025, Synthflow AI has experienced rapid growth, achieving 15x revenue growth

Key Features

No-code conversational AI voice agents for inbound and outbound calls, natural language understanding and speech synthesis, multilingual support, enterprise telephony integration, 24/7 call automation and CRM/ERP connections.

31. Sereact

Industry: Artificial Intelligence / Robotics / Autonomous Systems

Sereact is a German AI-powered robotics company that builds embodied AI software (vision-language-action models) enabling robots to perceive, reason and act autonomously in dynamic environments such as warehouses and manufacturing, with natural-language interaction and zero-shot task execution capabilities.

Location: Stuttgart, Baden-Württemberg, Germany

Founded: 2021

Last Funding Round: €25M Series A (2025) led by Creandum with participation from Point Nine and Air Street Capital plus angel investors

Total Funding: ~€30M+ disclosed (seed + Series A)

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (B2B logistics/manufacturing customers including BMW, Daimler Truck, Bol, Active Ants)

Growth Rate: Not publicly disclosed

Key Features

Embodied AI for robotics with zero-shot visual reasoning, natural language instruction interface (PickGPT), hardware-agnostic autonomy stack for pick-and-place and other complex tasks, rapid one-day deployment, continuous learning from real-world operation data.

32. Doinstruct

Industry: Artificial Intelligence / HR Tech / Compliance & Training AI

Doinstruct is a German AI-powered operational excellence and compliance training platform that automates frontline worker training, generates and updates multilingual training content, and ensures audit-ready compliance for deskless workforces.

Location: Berlin and Osnabrück, Germany

Founded: 2021

Last Funding Round: €16.5M Series A (2025) led by HV Capital and others

Total Funding: ~€26M disclosed (€7.6M earlier rounds + €16.5M Series A)

Valuation: Not publicly disclosed

Number of Users: ~350+ teams (enterprise and frontline customers)

Growth Rate: Not publicly disclosed

Key Features

AI-generated role- and site-specific training, automated compliance and documentation, multilingual content in 25+ languages, mobile-first platform, audit-ready reporting and integration with HR systems.

33. Born

Industry: Artificial Intelligence / Consumer AI / Social AI

Born is a German AI company that builds AI-powered social companion applications featuring interactive virtual characters that evolve, connect with users and promote shared digital experiences rather than isolated chatbot use.

Location: Berlin, Berlin, Germany

Founded: 2022

Last Funding Round: $15M Series A (2025) led by Accel with participation from Tencent and Laton Ventures

Total Funding: ~$25M total disclosed (including earlier seed)

Valuation: Not publicly disclosed

Number of Users: ~15M+ global users (Pengu app)

Growth Rate: The AI companion app market generated $82 million in the first half of 2025

Key Features

AI companion characters that grow and evolve, flagship Pengu virtual pet app with co-parenting gameplay, shared social experiences, freemium monetization with in-app purchases and subscriptions.

34. Kertos

Industry: Artificial Intelligence / RegTech / Compliance Automation

Kertos is a German AI-powered compliance automation platform that helps companies streamline and automate complex regulatory compliance and certification workflows (GDPR, ISO 27001, SOC 2, NIS 2, EU AI Act and more) by discovering assets, assessing risks, generating documentation and continuously monitoring audit readiness with intelligent agents and a no-code interface, making compliance faster and more efficient.

Location: Munich and Berlin, Germany

Founded: 2021

Last Funding Round: €14M Series A (2025) led by Portage with participation from Pilabs, Redstone, 10x Founders and seed+speed Ventures

Total Funding: ~€18M+ disclosed (seed rounds + Series A)

Valuation: Not publicly disclosed

Number of Users: Over 5k users

Growth Rate: As of mid-2025, Kertos hit $6.2 million in revenue

Key Features

AI-guided compliance automation across multiple regulatory frameworks, no-code workflow automation, asset discovery and real-time risk insights, automated compliance documentation and audit readiness, over 100 integrations with enterprise tools, built-in AI compliance agent “KAIA” to guide users step-by-step.

35. Okapi:Orbits

Industry: Aerospace / Space Tech / AI-enabled Space Traffic Management

Okapi:Orbits is a German space technology company that builds AI-powered space situational awareness (SSA) and space traffic management (STM) platforms to help satellite operators predict and avoid collisions, optimize mission planning and ensure sustainable, compliant orbital operations.

Location: Braunschweig, Lower Saxony, Germany

Founded: 2018

Last Funding Round: €13M Seed (2025) led by Ventech, Matterwave Ventures and others

Total Funding: ~€18M+ disclosed (~€13M 2025 + earlier seed)

Valuation: Not publicly disclosed

Number of Users: ~150+ users including satellite operators and institutional clients (estimated)

Growth Rate: Not publicly disclosed

Key Features

AI-based space traffic management software, real-time orbit risk prediction, collision avoidance, mission lifecycle simulation and compliance tools for satellite operations.

36. Mindpeak

Industry: Artificial Intelligence / Healthcare AI / Digital Pathology

Mindpeak is a German AI company that builds AI-powered digital pathology software to automate clinical tissue image analysis and biomarker quantification, helping pathologists increase accuracy, speed and reproducibility in cancer diagnostics and translational research.

Location: Hamburg, Germany

Founded: 2018

Last Funding Round: $15.3M Series A (2024) led by ZEISS Ventures and InnoVentureFund with participation from AI.FUND and the European Innovation Council Fund

Total Funding: ~$15.3M+ disclosed

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (used by pathology labs globally; supported 30,000+ diagnoses)

Growth Rate: 1600% increase in revenue

Key Features

AI-driven histopathology image analysis, zero-click biomarker quantification, digital pathology workflow integration, immunohistochemistry (IHC) automation, explainable AI outputs, support for research and clinical diagnostics.

37. OCELL

Industry: Climate Tech / Artificial Intelligence / Forestry Analytics

OCELL is a German climate-tech company that builds AI-powered forest analytics and climate project software to create digital twins of forests, enabling precise measurement of carbon storage, optimized forest management and high-quality, transparent carbon credit generation.

Location: Munich, Bavaria, Germany

Founded: 2019

Last Funding Round: €10M Series A (2025) led by Capnamic, Bayern Kapital and existing investors

Total Funding: ~€15M+ disclosed including prior seed and Series A

Valuation: Not publicly disclosed

Number of Users: ~3,500+ forestry professionals managing 800,000+ hectares of forest with OCELL software

Growth Rate: Not publicly disclosed

Key Features

AI-driven forest digital twins, aerial and LiDAR data analytics, carbon storage and growth forecasting, sustainable forest management insights, transparent MRV (measurement, reporting, verification) for climate projects and data-backed carbon credit generation.

38. Superlist

Industry: Productivity Software / Collaboration / Task Management

Superlist is a Berlin-based productivity and collaboration platform reimagining task and project management for modern teams by combining to-do lists, notes and workspaces in a unified tool built for hybrid work and real-time collaboration.

Location: Berlin, Germany

Founded: 2020

Last Funding Round: €10M Seed (2022)

Total Funding: ~€13.5M+ disclosed (seed + earlier rounds)

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (productivity app used by individuals and teams globally)

Growth Rate: reaching $2 million in revenue as of June 2024

Key Features

Unified task and project management, collaborative lists and notes, real-time team workflows, integrations with calendars and external tools, cross-platform support on web and mobile, AI-enhanced productivity features.

39. Workist

Industry: Artificial Intelligence / Business Process Automation / Enterprise SaaS

Workist is a Berlin-based AI company that builds AI-powered automation software (AI Workers) that automatically processes unstructured business documents (orders, invoices, delivery notes, emails) and integrates data directly into enterprise systems to eliminate manual work in B2B transactions and improve operational efficiency.

Location: Berlin, Germany

Founded: 2019

Last Funding Round: €9M Series A (2022) led by Earlybird Venture Capital with participation from 468 Capital, LEA Partners and another.vc

Total Funding: ~€12M+ disclosed across seed and Series A

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (enterprise customers include large manufacturers and distributors such as Deutsche Bahn, PepsiCo, Zentis)

Growth Rate: Rapid customer and revenue growth reported early (e.g., 1100% MRR growth in early stages)

Key Features

AI-driven document and order processing, intelligent data extraction from unstructured formats, seamless integration with ERP/CRM systems, automated workflows for sales/operations/procurement to reduce errors and manual tasks.

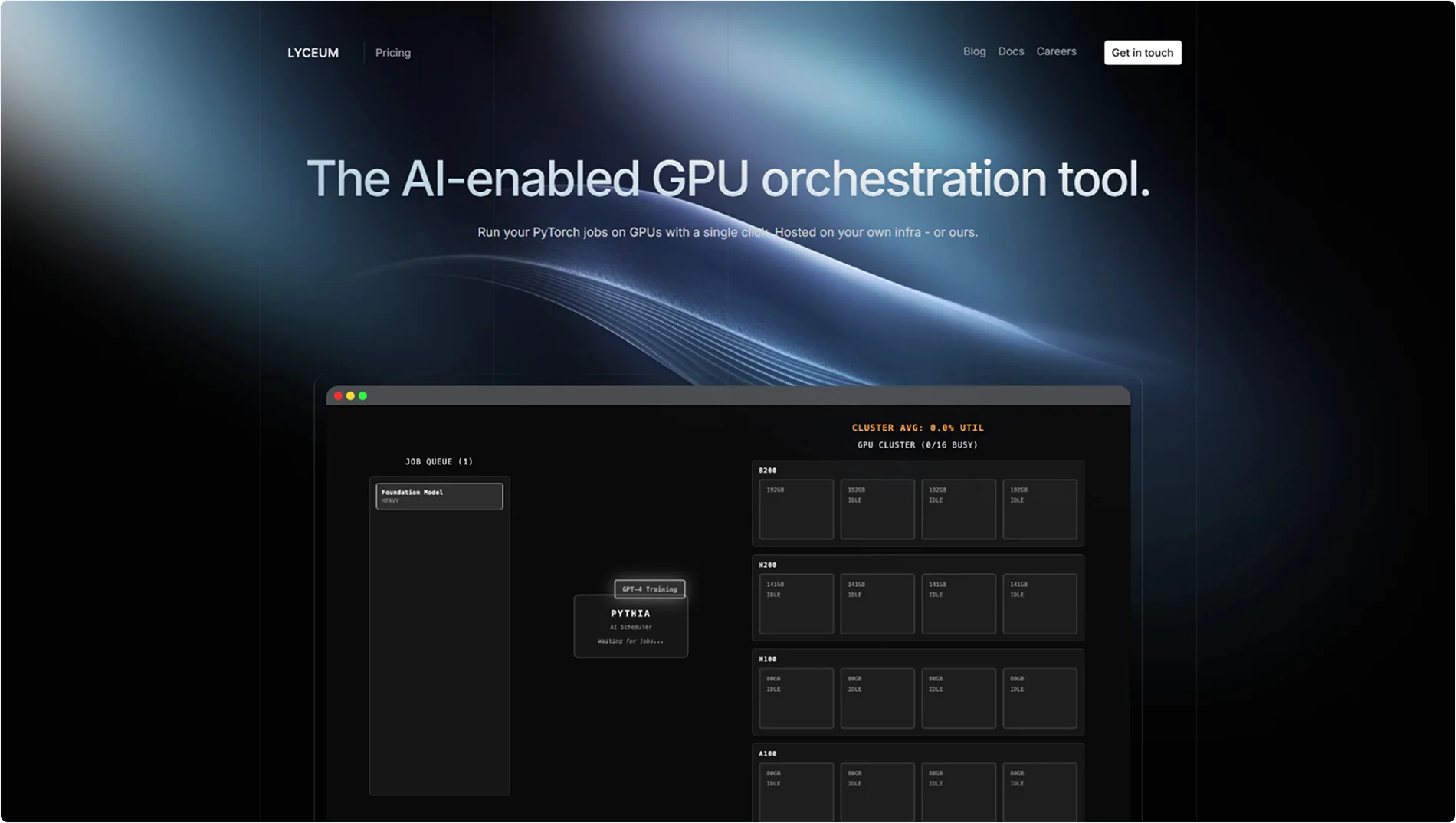

40. Lyceum

Industry: Cloud Infrastructure / Artificial Intelligence / GPU Compute

Lyceum is a German/European AI infrastructure startup building a sovereign, developer-friendly GPU cloud platform that simplifies access to high-performance compute for AI model training, deployment and simulation with one-click GPU provisioning and transparent pricing, focused on EU data sovereignty and energy-efficient hosted compute.

Location: Berlin, Germany (with operations in Zurich and planned EU data centers)

Founded: 2025

Last Funding Round: €10.3M Pre-Seed (2025) led by redalpine and 10x Founders

Total Funding: ~€10.3M+ disclosed (~$12M)

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (targeting developers, startups, enterprises and research institutions)

Growth Rate: Not publicly disclosed

Key Features

Sovereign GPU cloud for AI compute, one-click GPU deployment, automated hardware selection, transparent pricing, EU data residency and security-by-design principles, scalable infrastructure for model training and AI workloads.

41. Nyris

Industry: Artificial Intelligence / Visual Search / Computer Vision

Nyris is a German AI company that builds an AI-powered visual search and image recognition platform enabling companies to identify products, spare parts and objects from images and CAD data with high accuracy and speed, helping industrial, retail and manufacturing customers improve search experiences, inventory workflows and maintenance processes.

Location: Berlin and Düsseldorf, Germany

Founded: 2015

Last Funding Round: ~€10M Series C (2023) led by Trumpf Venture and European Innovation Council (EIC) Fund

Total Funding: ~€10M+ disclosed (prior strategic investments from IKEA, eCAPITAL, SEK Ventures)

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (serves customers across 50+ countries in retail and industrial sectors)

Growth Rate: reached $2.5 million in annual revenue with a team of 25 people

Key Features

AI-driven visual search and object recognition, rapid spare part identification, integration with enterprise systems (e.g., SAP), synthetic image data generation for enhanced search accuracy, scalable API for retail and manufacturing use cases.

42. hallo theo

Industry: PropTech / Digital Property Management / AI‑Enabled Real Estate Services

hallo theo is a Berlin-based PropTech company that builds a tech-powered digital property management platform and service to modernize and automate residential and rental property administration, improving data quality, responsiveness and customer experience with AI and automation at its core.

Location: Berlin, Germany

Founded: 2023

Last Funding Round: €10M Seed (2025) led by Insight Partners

Total Funding: ~€10M+ disclosed

Valuation: Not publicly disclosed

Number of Users: ~17,000+ managed units (multiple thousands of properties across Germany)

Growth Rate: Monthly Growth Rate>30%

Key Features

Digital and AI-assisted property management services, automated workflows and bookkeeping, tenant and owner communications, transparent reporting, regional property manager network with standardized processes, technology-first operations to replace outdated manual systems.

43. Flank

Industry: Artificial Intelligence / Enterprise AI / Legal Automation

Flank is a German AI company building autonomous AI legal agents that integrate directly into business workflows (email, Slack, Teams) to autonomously review, draft, red-line and answer legal and compliance requests for enterprise teams, reducing manual legal workload and accelerating operations.

Location: Berlin, Germany

Founded: 2018 (originally Legal OS, rebranded to Flank)

Last Funding Round: $10M funding led by Insight Partners (2025)

Total Funding: ~$10M+ disclosed funding

Valuation: Not publicly disclosed

Number of Users: Not publicly disclosed (enterprise customers including DeepL, SumUp, TravelPerk, Bolt)

Growth Rate: Triple-digit revenue growth reported in 2025

Key Features

Autonomous AI legal agents, embedded into existing tools, automated contract review and drafting, compliance query resolution, proprietary agentic framework, vector-less retrieval engine, enterprise governance and supervision controls.

44. Futurail

Industry: Artificial Intelligence / Autonomous Mobility / Rail Tech

Futurail is a German-led deep-tech startup that builds an AI-powered autonomy stack for self-driving trains to enable fully autonomous rail operations, helping rail operators improve efficiency, safety and sustainability while addressing driver shortages and reducing operating costs.

Location: Munich, Bavaria, Germany (also Franco-German presence in Strasbourg)

Founded: 2023

Last Funding Round: €7.5M Seed (2025) led by Asterion Ventures, Leap435 and others

Total Funding: ~€7.5M disclosed

Valuation: Not publicly disclosed (estimated early-stage growth)

Number of Users: Not publicly disclosed (B2B operator and OEM customers)

Growth Rate: Not publicly disclosed

Key Features

AI and sensor-fused autonomy stack for rail (FUTURAILDriver) with long-range obstacle detection, precise localization and autonomous control, retrofit and OEM integration options, safety-certified hardware and software tailored for passenger and freight rail digital transformation.

Conclusion

What connects these companies isn’t just that they operate in AI, it’s the scale of their ambition and the speed of their execution. From generative models and enterprise automation to robotics, healthcare, climate tech, and industrial intelligence, they’re not just improving workflows; they’re redefining how entire industries operate.

Bringing AI-driven ideas to life requires more than great models — it takes strong product design, data pipelines, infrastructure, and go-to-market execution. Partnering with an experienced AI development team helps startups build reliable, scalable and compliant systems that can move from prototype to real-world impact.

With the right technical and commercial foundations, these German AI startups are positioned to expand globally, attract enterprise adoption, and shape the next wave of intelligent software and machines.

For AI startups ready to grow faster and reach the right audience, Omnius provides SEO, GEO, development and content marketing built for B2B tech — turning cutting-edge AI into discoverable, compounding growth.

.png)

.svg)

.svg)

.png)

.png)