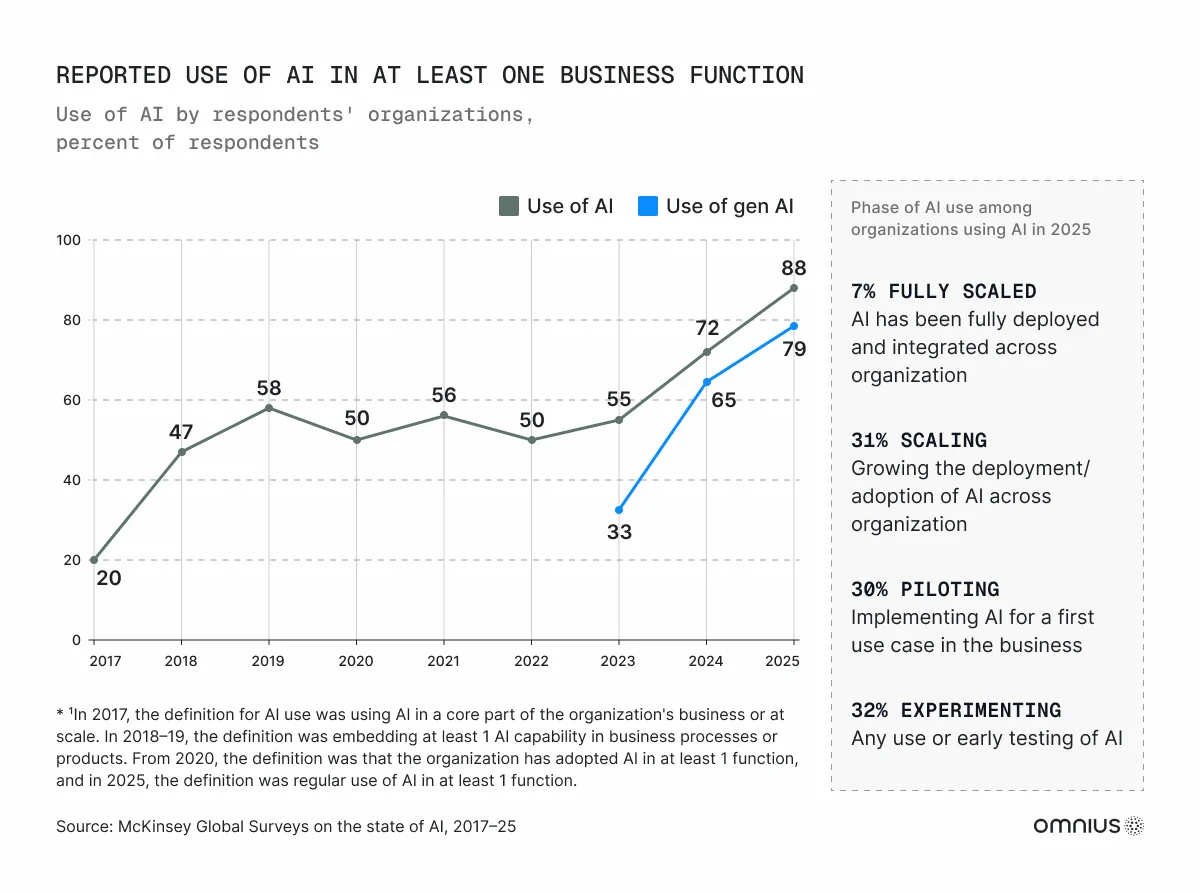

AI search and Generative Engine Optimization now sit at the centre of how online discovery and evaluation work. A growing share of product research and intent formation happens inside AI interfaces rather than only on traditional SERPs.

Users increasingly ask ChatGPT, Perplexity, Gemini and Copilot to summarise options, explain trade-offs and suggest next steps. Traditional search still carries most search-originated traffic, but AI engines increasingly decide which brands enter the conversation at all.

This report analyses the AI search and GEO market in 2025: volumes, adoption, performance patterns and tooling. It draws on the AI Search Industry Report 2025, the GEO Industry Report 2025 and related content, together with independent research on AI search usage and zero-click behaviour.

It describes what is changing and how it reshapes organic discovery for organisations that depend on search.

1. AI Search Already Operates at Internet Scale in 2025

The Generative AI Statistics: 2025 Report estimates that by May 2025, AI chatbots and answer engines share the generative search and recommendation market roughly as follows.

Table 1. AI chatbot and answer engine market share (mid-2025)

The AI Search Industry Report 2025 combines monitoring, client analytics and third-party suites and estimates that major AI engines together process tens of billions of prompts per month, with a substantial and rising fraction of those prompts explicitly “search-like” (product discovery, comparison and solution research).

At the same time, traditional search remains very large. Analyses based on Google disclosures and independent work from SparkToro suggest more than five trillion Google searches per year, or roughly 13-14 billion searches per day, with Google still responsible for close to 90% of global search engine queries in many regions.

Data snapshot - AI search and classic search volumes in 2025

- Google Search: 5T+ queries per year, ≈13-14B per day

- Combined AI engines: tens of billions of prompts per month

- ChatGPT: ≈60% share of AI search chatbot usage

These numbers show that AI search is no longer a niche channel. ChatGPT and a small group of competitors now operate at a scale measured in billions of prompts per day, with market share concentrated in a few engines.

Traditional search is still larger in absolute volume and remains the main backbone of search-originated traffic. AI search has not replaced this volume; it has layered itself on top of it.

In practice, many journeys now start in an AI engine and then spill over into Google, direct navigation or app-based exploration once options have been narrowed. AI search determines which stories and brands enter the evaluation set, while classic search and websites handle verification, detailed comparison and transactions.

2. AI Answer Elements Compress Classic Organic Clicks but Improve Visit Quality

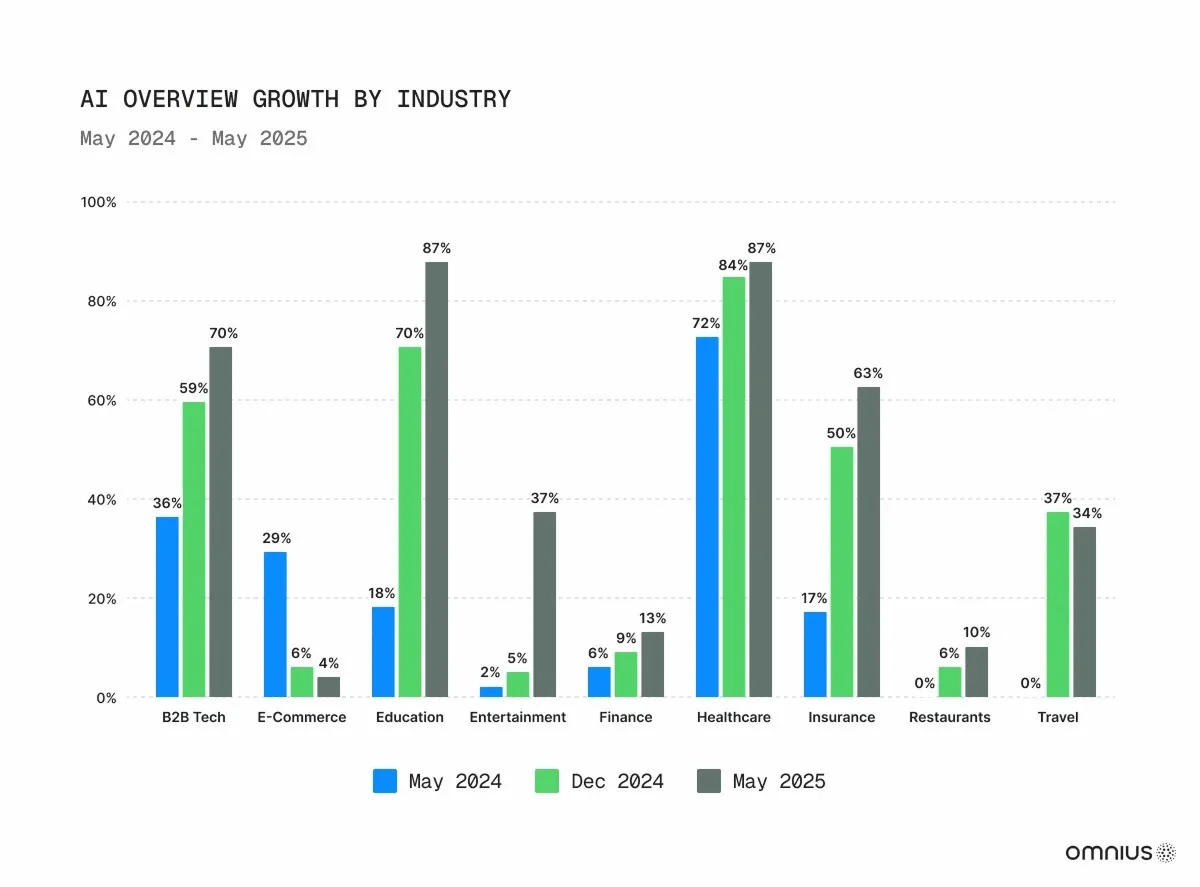

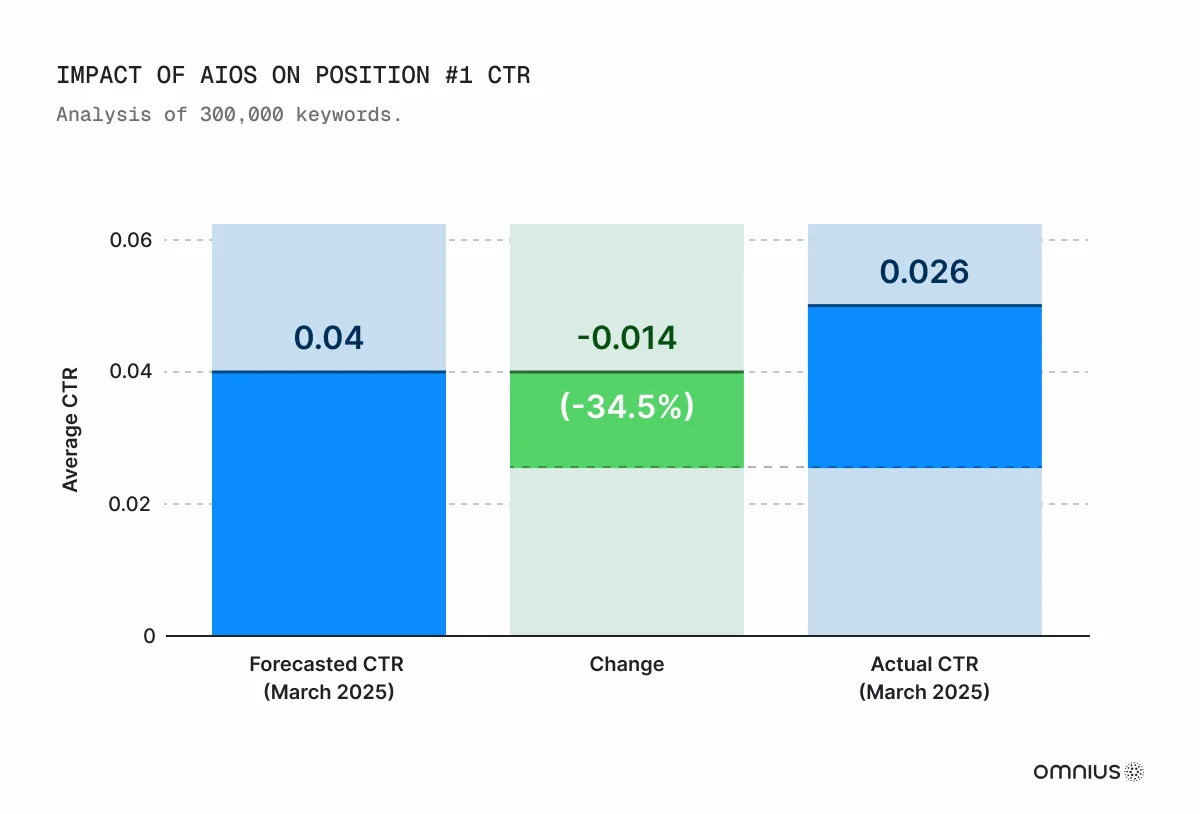

The AI Search Industry Report 2025 synthesises multiple analyses of Google AI Overviews, including studies from Ahrefs and Amsive, and coverage from Search Engine Land.

Across these data sets, a consistent pattern appears when AI Overviews or similar answer blocks are present on a SERP:

- position-1 organic CTR often falls by roughly 20-35%, depending on vertical

- total organic clicks on the page tend to decline, even though total impressions rise

In parallel, the GEO Industry Report 2025 summarises conversion benchmarks across a set of B2B and SaaS funnels. In those data:

- AI-sourced visits convert at roughly 4.4× the rate of typical organic sessions

- deals influenced by AI engines earlier in the research phase show higher average contract values in several cases

Consumer research referenced in the same report cites a study where 58% of consumers now rely on AI for product recommendations, more than double the share two years earlier.

Table 2. Impact of AI elements on traffic and conversion (indicative)

Table 3. Example comparison of SERP and AI-sourced performance

The most immediate impact of AI search appears simultaneously in classic SEO performance metrics and conversion metrics for AI-originated sessions.

AI answer blocks on SERPs increase visibility but intercept a larger share of user intent before any click. At the same time, sessions that arrive from AI assistants are fewer but typically represent users who are further along in their decision process.

Classic organic traffic is under pressure from AI elements on SERPs. Position alone is no longer a reliable proxy for clicks, especially on pages with prominent generative answer blocks.

AI search sends fewer visits overall, but those visits tend to be later-stage and more qualified, which redistributes traffic value across channels and reinforces GEO as a complement rather than a replacement for SEO.

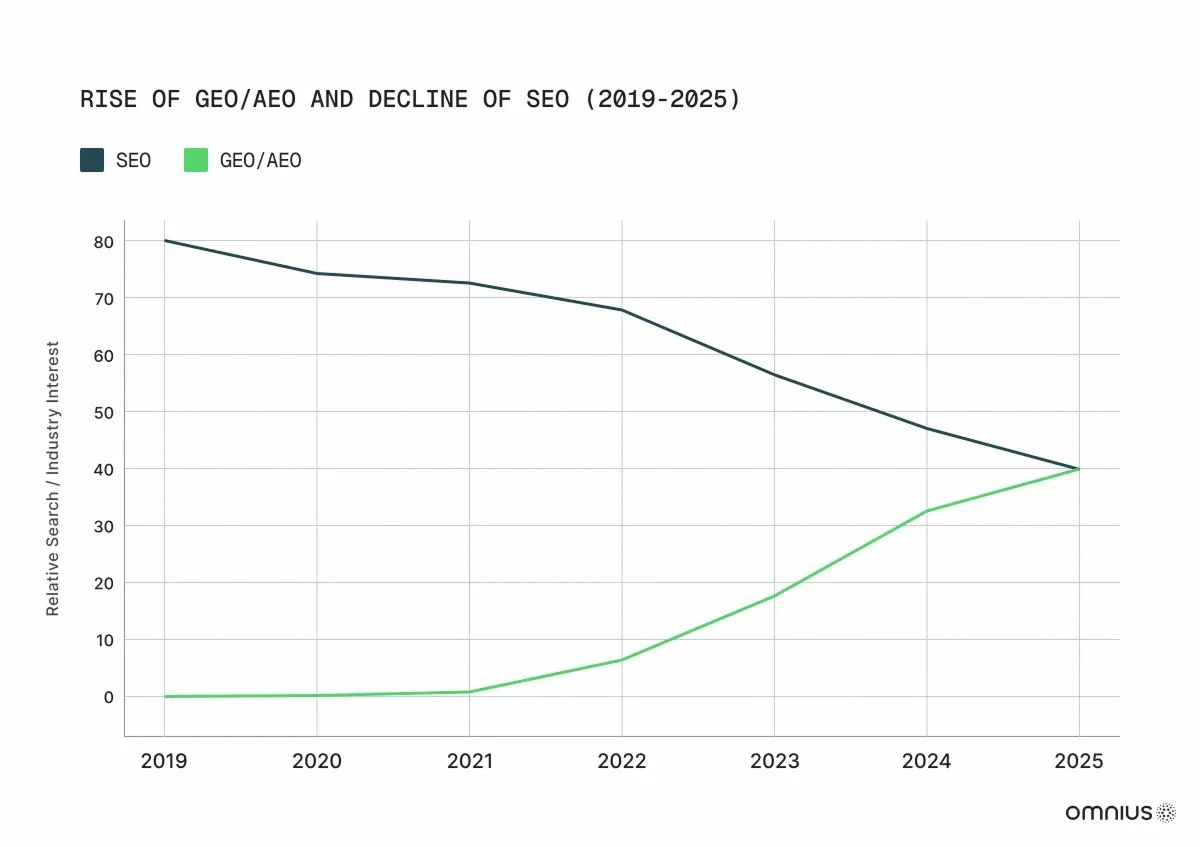

3. GEO Has Evolved into a Mainstream Component of Search Strategy

A 2025 GEO statistics round-up from Gauge, cited in the AI search monitoring and LLM tracking tools, reports that:

- around 63% of marketers now say they actively consider generative engines in their search plans

- a growing minority already have explicit GEO KPIs such as AI citation share, “share of answer” or answer-level brand recall

The guide to AI search monitoring software lists more than 30 products focused specifically on generative engines, including GEO-native platforms (Gauge, Profound, Atomic AGI, AthenaHQ) and AI-enhanced extensions of classic SEO suites.

Table 4. GEO adoption indicators in 2025 (selected)

These signals indicate that GEO has moved beyond experimental status. Marketers increasingly treat AI engines as standard components of search strategy, even when reporting and attribution are still anchored in traditional SEO metrics.

Investment in tooling suggests that vendors expect GEO to become a long-term discipline, not a short-lived trend. In more mature teams, GEO is shifting from one-off innovation projects into planned budget lines and KPIs, with dedicated tracking of AI citations, AI visibility and entity work.

4. A Specialised Tooling Stack Now Supports AI Search and GEO

The AI search and GEO tooling landscape in 2025 can be described as a three-layer stack standing alongside familiar SEO tools. This structure is outlined across the AI search monitoring software guide and the AI and LLM tracking overview.

Table 5. The emerging AI search and GEO tooling stack

Case studies referenced in the AI Search Industry Report 2025 highlight examples where:

- AI Overview impressions increased by up to 11×

- AI citation rates roughly doubled over a quarter

- a material share of booked demos was linked to improved GEO visibility over time

This stack captures the convergence between SEO and GEO. Monitoring tools treat AI answers as a measurable surface, SEO platforms bring AI panels into scope, and GEO engines orchestrate prompts, content and measurement around AI environments.

For teams building GEO capabilities, the stack provides ways to observe AI answer behaviour, generate signals for prioritising content and entity changes and establish early benchmarks for GEO effectiveness (impressions, citations, downstream conversions).

The existence of a distinct GEO stack is itself evidence that AI search has become operationally important, not only a theoretical concern.

5. Content Entities and External Evidence Are Being Re-optimised for AI Environments

Across case studies and research, several recurring patterns appear in how teams adapt SEO and GEO playbooks for high-value pages. These patterns are reflected in the GEO Industry Report 2025, the AI Search Industry Report 2025 and the GEO strategies.

- Answer-first, data-dense content - Instead of thin, keyword-heavy pages, AI search tends to favour content that opens with clear factual statements near the top and then supports them with specific, recent statistics and benchmarks. These paragraphs can be lifted directly into an answer block with minimal editing.

- Entity and brand signal consolidation - GEO programmes often begin with an “entity audit” that aligns brand, product and category descriptions across websites, documentation, LinkedIn, review platforms and directories; implements or cleans schema markup for organisation, product, article and FAQ content; and ensures that key facts (what the company does, who it serves, where it operates) are expressed consistently.

- Shift from purely owned content to broader earned evidence - Research on generative engines shows a strong bias towards earned media such as editorial coverage, reviews, comparison pieces and analyst reports. In practice, this makes PR, analyst outreach and expert contributions, together with detailed third-party write-ups and reviews, as important for AI visibility as on-site copy.

Table 6. Illustrative comparison of SEO-first vs GEO-aware content focus

These patterns show that GEO is not only a technical layer on top of existing SEO. It changes what “good content” looks like: pages need to be SERP-aligned and answer-ready at the same time, with clear definitions, structured explanations and credible data.

It also increases the importance of external validation: reviews, comparisons and analyst coverage become critical inputs into how models describe and prioritise brands in answers.

Teams that adapt playbooks around these principles are more likely to see faster discovery and more favourable framing in AI answers than teams relying only on legacy SEO tactics.

6. Measuring GEO Adds New Layers on Top of Classic SEO Metrics

Traditional analytics tools were designed around clicks, sessions and rankings. GEO introduces layers that sit above and around these metrics. The article on how AI and LLM tracking tools work and the AI search monitoring software guide outline a practical structure for this measurement.

Table 7. GEO measurement layers and questions

These dimensions extend classic SEO dashboards rather than replacing them. Rankings and organic traffic remain core, but they do not capture how frequently AI answers mention, frame or recommend a brand.

Linking AI answer behaviour with traffic and pipeline data is still emerging practice, but it allows teams to tie GEO work directly to commercial outcomes rather than treating AI search as unmeasurable background noise.

Over time, GEO programmes are likely to adopt their own standard metrics, for example, AI citation share on priority prompts, alongside rankings and organic sessions.

7. Key Findings

Taken together, the preceding sections point to several overarching findings.

- AI search now operates at internet scale and continues to grow.

ChatGPT and a small group of competitors handle billions of prompts per day and tens of billions per month, with market share concentrated in a few engines. - Traditional search remains dominant in volume but is increasingly layered with AI behaviour.

Google continues to process trillions of searches per year and drives most search-originated sessions, while many user journeys now begin in AI interfaces and flow back into search later. - AI answer blocks reduce classic CTR and change how SERP performance must be interpreted.

Top-position CTR and total organic clicks often fall when AI Overviews are present, even as impressions rise, which alters the relationship between rankings and traffic. - AI-originated traffic is smaller in volume but stronger in intent and commercial impact.

AI-sourced visits frequently convert several times better than standard organic sessions and tend to appear later in the decision process. - GEO has moved from experiment into structured practice with dedicated tools and KPIs.

Most surveyed marketers now consider generative engines in their plans, and a distinct GEO stack has emerged for monitoring, content and optimisation. - Content and evidence requirements are shifting towards answer-first, entity-clear and evidence-rich assets.

Answer-first, data-dense, entity-clear content and a strong earned-media footprint are increasingly necessary for visibility in AI answers. - Measurement is expanding to include AI answer behaviour alongside rankings and traffic.

GEO extends SEO metrics with AI-specific views of visibility, conversions and brand positioning, bringing AI search into the same performance conversations as traditional search.

8. Conclusion

By the end of 2025, AI search and GEO are no longer side projects - they are part of how organic discovery works every day.

People still search on Google. They still find products, compare options and convert through classic SERPs. That has not gone away. But more of the research now starts in AI engines. They set the context, frame the options and decide which brands make it into the short list.

In that environment, traditional SEO is still non-negotiable. Without a technically healthy, intent-aligned site, it is hard to qualify for AI citations at all.

At the same time, qualification is not enough. Visibility depends on being one of the few sources AI engines choose to quote when they answer the questions that matter in your category.

The data in this report points in the same direction. AI search already runs at internet scale, led by ChatGPT and a small group of fast-growing competitors. AI-originated traffic is smaller in volume but converts much better than standard organic search. And teams that treat GEO as a structured discipline, with clear benchmarks, tools and playbooks, are already being discovered and framed more favourably in AI answers than those who wait.

AI search and GEO will not replace traditional search overnight. But they are already influencing who gets heard first.

If you want support turning these insights into a concrete roadmap, you can reach out to us for a GEO and AI search assessment tailored to your market.

9. FAQ

Q1. Is AI search taking traffic away from traditional SEO?

AI search is not replacing traditional search, but it is changing how traffic is distributed. When AI answer blocks appear on SERPs, click-through rates on top organic results often decline even as impressions increase. At the same time, AI-sourced traffic, although smaller in volume, tends to be more qualified and converts at higher rates. SEO remains essential, but ranking first is no longer a guarantee of capturing most clicks.

Q2. Is separate content required for GEO or can existing SEO content be used?

In most cases, a separate content universe is not required for GEO. The more common pattern is to adapt existing SEO content so that it is answer-first, data-dense and entity-clear, rather than creating pages exclusively for AI engines. A single article can both rank in SERPs and serve as a reliable citation source for AI answers when it is structured with both use cases in mind.

Q3. How can the influence of AI engines on pipelines be detected?

The influence of AI engines usually appears through a combination of signals. These include modest but rising volumes of traffic from AI-related referrers, prospects mentioning AI tools in discovery conversations, shifts in branded search volume after changes in AI answer visibility and qualitative feedback from sales teams. When viewed together, these signals help connect AI citations with leads, opportunities and revenue.

Q4. What is a practical starting point for teams that have never worked on GEO?

A pragmatic starting point is to select a small set of high-value topics, typically a core product category and a few priority use cases, and audit current visibility. This includes positions in traditional search, presence and framing in responses from leading AI engines and the competitors that appear most often. Based on that snapshot, teams can prioritise entity clean-up, content updates and basic AI search monitoring for those topics before expanding GEO efforts more broadly.

.png)

.svg)

.svg)

.png)

.png)